Mergers & Acquisitions and Capital Markets Update

By Clint Bundy

As the broader economy navigates a unique and volatile first half of the year, questions loom over what lies ahead for the automation mergers and acquisitions (M&A) landscape in 2025.

To provide clarity on this evolving market, I start with a real-time assessment of broader M&A conditions — offering essential context for emerging trends in automation, including the control system integration segment, a key submarket within the larger automation industry.

Complementing this market snapshot, I also wanted to offer an update on the automation and control system integration M&A markets.

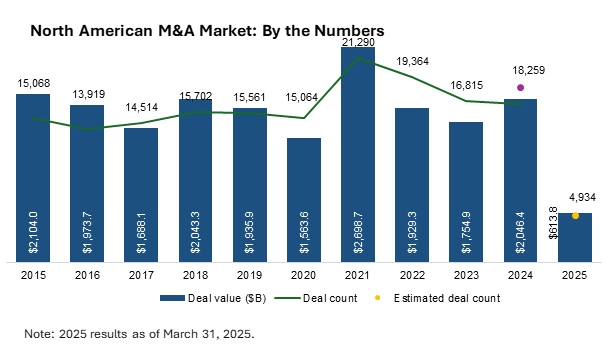

North American M&A Market

Business owners considering a sale or acquisition should understand the recent M&A market cycle.

In 2021, North American M&A activity reached an all-time high of $2.7 trillion, driven by low interest rates, a backlog of deals from the pandemic, and strong buyer demand.

Activity cooled in 2022 and 2023, as rising interest rates and greater caution from buyers led to a decline in deal flow — dropping to $1.8 trillion by 2023, according to PitchBook.

Encouragingly, 2024 has brought renewed momentum in terms of transaction activity. As buyers adjusted to the higher rate environment and became more active, 2024 transaction value climbed roughly 16% over the prior year, reaching $2.0 trillion.

In Q1 2025, North American M&A activity was robust, with total transaction value reaching $614 billion across nearly 5,000 deals, according to PitchBook.

Recent geopolitical and macroeconomic developments, including tariffs, lowering consumer confidence, and a contracting U.S. GDP in Q1 2025, have transaction professionals closely monitoring how this might impact M&A activity.

While Bundy Group maintains a strong focus on the automation and control system integration sectors, I am also observing robust buyer interest across other business services and tech-enabled services segments.

At the same time, experienced buyers in these sectors are applying greater scrutiny and diligence to potential acquisitions — carefully assessing factors such as geopolitical volatility and their potential impact on future company performance.

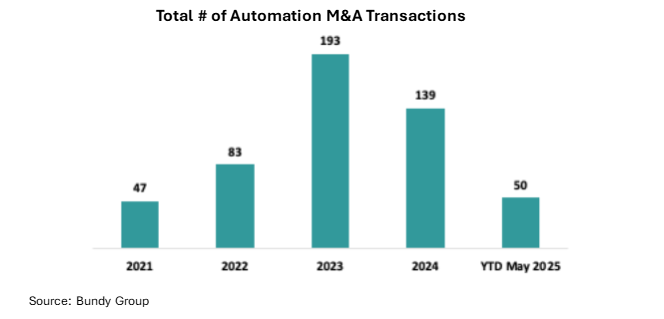

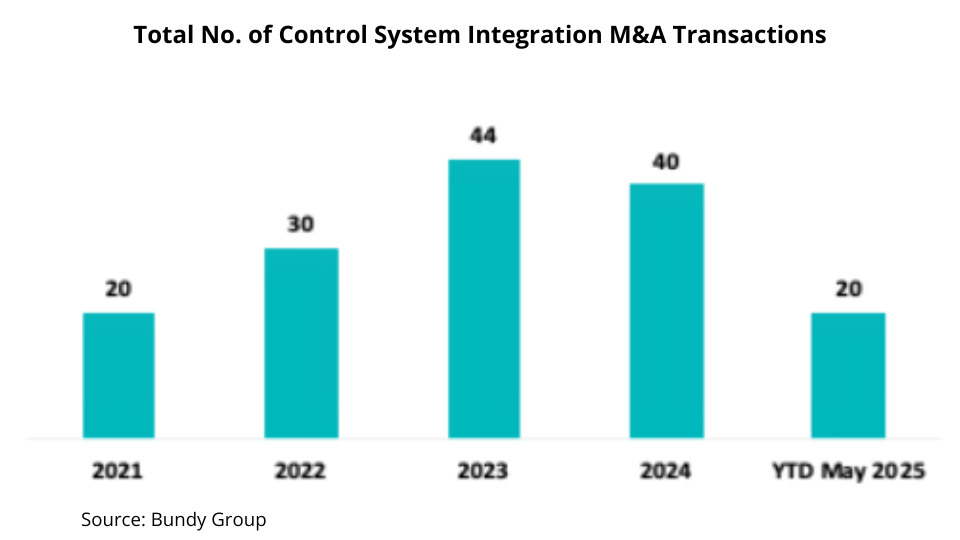

Automation Solutions and Control Systems Integration Markets

As a specialist in the automation segment for over 15 years, Bundy Group has consistently witnessed strong momentum in the M&A market for automation solutions companies.

This growth is driven by several key factors: the sector’s inherent resilience, ongoing market expansion, a highly fragmented provider landscape, and the strong investment returns realized by groups that have acquired, scaled, and exited automation solutions businesses.

As illustrated in the two charts below, both the broader automation M&A market and the control systems integration space continue to experience a robust pace of transaction activity — clear evidence that buyers and sellers remain highly active in these segments.

Bundy Group’s ongoing work within the automation and control system integration sectors gives us a unique advantage to share proprietary market insights.

Recent transaction experience includes the successful sale of two automation solutions companies — CITI and EPIC Systems — in the past four months alone.

Client engagements, along with current mandates in the space, offer key takeaways for business owners and investors evaluating opportunities in this dynamic market.

Takeaways on the Automation and Control System Integration M&A Markets

- Robust Buyer Demand: Automation and control systems integration firms remain highly sought after by both financial sponsors (i.e., investors) and strategic buyers (i.e., operating companies seeking add-on acquisitions). Buyer demand continues to outpace supply, particularly for high-quality automation solutions businesses –creating a competitive environment that favors sellers.

- Buyer Separation: Serious buyers in the automation and control system integration markets seek to thoroughly understand a company before submitting a Letter of Intent (LOI) or offer. In contrast, opportunistic buyers often bypass early diligence, which can signal a higher likelihood of retrading on terms or walking away during due diligence. Inherent knowledge of the pool of buyers, and how they perform when the “rubber meets the road,” is critical.

- International Buyer Presence: Today’s geopolitical and macroeconomic conditions are accelerating strategic and financial sponsor buyer interest in the North American market. We had one automation client sell in 2025 to a European-based strategic buyer, and we had another industrial client sell this year to a Japanese-based publicly traded conglomerate. Both buyers were aggressive in their pursuit of the opportunities and in their value / structuring on the respective transactions.

- Competition Translates to Value: We specialize in representing running competitive processes on behalf of our clients in a sale process. We continue to see that no two buyers value a company the same way, and that a competitive process yields the best results.

The percentage spread between the highest offer and the lowest offer on four recent automation transactions were as follows:

- Automation Client 1: 108%

- Automation Client 2: 91%

- Automation Client 3: 198%

- Automation Client 4: 143%

To illustrate sample math using a 198% spread: If the lowest offer was $20 million, the highest would be approximately $59.6 million — a $39.6 million difference that highlights just how impactful buyer competition can be in a sale process.

- Financial and KPI Preparation: Seasoned buyers are more willing to compete and pay higher valuations for companies that are deemed lower risk investments. A significant factor in determining risk is the depth of financial details and systems that a company has implemented. Further areas of focus include:

- Revenue recognition: An area of great focus and scrutiny in due diligence by buyers. We encourage owners to seek advice from advisors (transaction accounting firm; investment banking advisor) on critical items and potential missteps with revenue recognition, including percentage of completion accounting, owners make that can impact value in a sales process.

- Backlog conversion: Since buyers are acquiring the future, they focus mightily on conversion of pipeline to backlog according to company projections. If the company is consistently missing its backlog conversion, then that can create doubt about the company’s future performance.

- Financial controls: Lack of financial controls and systems, which can’t support detailed financial requests, increase riskiness of a company in eyes of a buyer.

Clint Bundy is managing director of Bundy Group, a boutique investment bank that specializes in representing automation, systems integration, industrial technology, Internet of Things, and cybersecurity companies in business sales, capital raises, and acquisitions. Over the past 35 years, Bundy Group has advised and closed on over 250 transactions, which includes numerous automation-related transactions.