By Clint Bundy

Heading into 2025, the mergers and acquisitions (M&A) market was positioned for a strong year. Despite the broader economy and geopolitical environment introducing potential headwinds and uncertainty, the first three quarters of this year did not disappoint from an M&A activity standpoint.

Furthermore, the broader automation solutions segment and the control system integration subsegment also remained highly active from an M&A standpoint.

To provide clarity on this evolving landscape, this update begins with a real-time assessment of broader market conditions — offering essential context for emerging trends shaping the control system integration sector.

It also includes an update on M&A activity across both the control system integration and broader automation solutions markets.

North American M&A Market

As we move through 2025, North American M&A activity continues to redefine itself in real time. After the volatility and rate-driven recalibration of 2022–2023, the market entered this year with a healthier balance between caution and conviction.

2024 set the stage as a rebound year, and 2025 has furthered that momentum. Buyers have become increasingly comfortable operating in a higher-rate environment and that renewed confidence is reflected in deal pipelines, valuation discussions, and diligence activity across multiple sectors.

North American M&A Market: By The Numbers

Note: 2025 results as of Sept 30, 2025

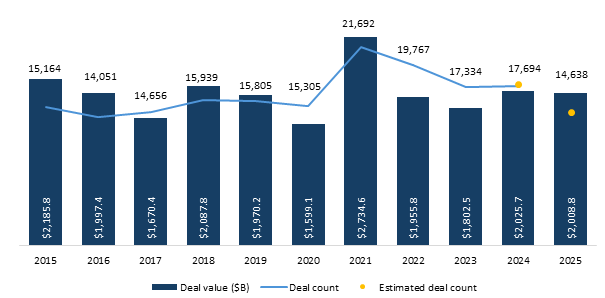

By the end of the third quarter of 2025, M&A activity in North America reached $762.2 billion across 5,066 announced or completed deals, according to PitchBook. This marked a new quarterly record for total deal value, eclipsing the prior high from Q4 2021. Deal count also climbed to its strongest performance since early 2022 — a sign that both strategic and financial acquirers are re-engaging at scale.

This strong performance through Q3 2025 was supported by several notable drivers:

- A meaningful rise in larger-scale transactions: Corporate-level deals and megadeals accounted for a significant share of total value, underscoring renewed confidence among both strategic and financial acquirers.

- Sustained momentum across core B2B segments: Activity within the broader business-to-business landscape — and its related subsegments — continued to outperform, reflecting steady demand for mission-critical products, services, and solutions.

- Improved buyer confidence fueled by shifting economic conditions: Recent interest-rate cuts and greater clarity around near-term economic risks helped ease earlier uncertainty, allowing dealmakers to re-engage pipelines with increased conviction.

- Significant capital availability among both sponsors and strategics: Financial sponsors remain well capitalized, and corporate buyers continue to carry strong balance sheets. This combination has created elevated competition for high-quality, growth-oriented businesses across multiple sectors.

Through Q3, North America remained on pace to finish 2025 with approximately $2.7 trillion in total transaction value, supported by a robust pipeline of market activity, continuing a three-year growth trend, according to PitchBook.

Bundy Group remains focused on the B2B and tech-enabled services markets — both of which cover automation solutions and control system integration companies — and we continue to see steady deal flow across these segments.

While enthusiasm for high-quality companies remains strong, seasoned acquirers are approaching transactions with sharpened discipline. They are scrutinizing revenue visibility, backlog conversion patterns, and the resilience of project pipelines under various economic scenarios.

Their aim is consistent: to find strong businesses while maintaining valuation and structural discipline.

The Control System Integration M&A Market

For more than 16 years, Bundy Group has served as a dedicated M&A advisor to the control system integration sector, and over the past decade has consistently observed strong, sustained momentum in this market.

Several structural factors continue to drive this activity: the sector’s inherent resiliency, ongoing expansion of automation demand, a highly fragmented integrator landscape, and the compelling investment returns realized by buyers that have acquired, scaled, and successfully exited integration businesses.

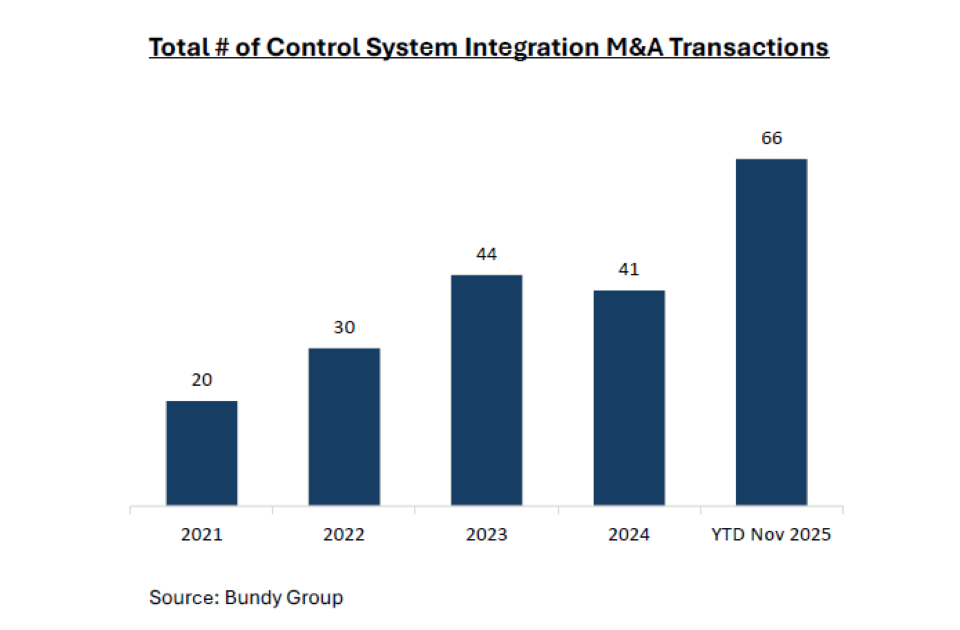

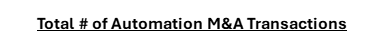

As the accompanying charts illustrate, both the control system integration and broader automation solutions markets remain exceptionally active — clear evidence that buyers and sellers are fully engaged.

As of November 2025, the number of control system integration transactions has already reached a record high, underscoring the strength of this segment.

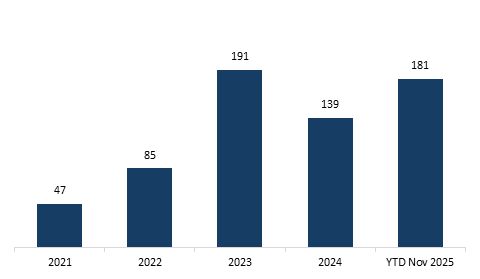

Bundy Group’s recent transaction activity reflects this momentum as well, including the successful sales of LangeTech, CITI, and EPIC Systems within the past eight months.

Active mandates and near-term pipeline reinforce the same theme: the control system integration M&A market continues to demonstrate meaningful runway, with no signs of slowing heading into 2026.

Takeaways on the Automation Solutions and Control System Integration M&A Markets:

Broad-Based Sector Activity

M&A activity across the automation solutions landscape remained active and diverse in 2025. In addition to control system integration, strong transaction flow occurred in robotics, industrial software, and AI-enabled automation, alongside meaningful activity in key verticals such as water/wastewater, food & beverage, medical, and semiconductors. These segments continue to demonstrate resilient demand and attract buyers seeking long-term growth exposure.

Diverse and Competitive Buyer Universe for System Integrators

Control system integration firms remain highly sought after, drawing interest from a wide range of acquirers, including:

- Financial sponsors (private equity and institutional investors)

- Sponsor-backed strategics pursuing add-on acquisitions

- Corporate strategic buyers (public companies and conglomerates)

- International acquirers targeting expansion within North America

This depth and diversity of buyer types provide business owners with more strategic options during a sale process. Importantly, demand continues to outpace supply —particularly for high-quality integration firms — creating a seller-friendly market environment.

Understanding Buyer Behavior Matters

Sophisticated financial sponsors and strategic acquirers typically conduct thorough, front-end diligence before submitting a Letter of Intent (LOI). Conversely, more opportunistic buyers may skip early diligence, a behavior that often correlates with retrading attempts or deal fatigue during later stages.

Having deep insight into buyer tendencies — and knowing which groups consistently perform when the “rubber meets the road”— is critical for achieving a smooth, efficient, and successful M&A process.

Control System Integration Transactions Case Study: CITI

Clint Bundy is managing director with Bundy Group.