By Bryan Powrozek

Industrial automation is evolving at a pace few could have predicted. As technology reshapes manufacturing and control systems, mergers and acquisitions (M&A) have become a strategic lever for growth, innovation, and resilience.

For companies in this space, understanding the forces driving M&A — and the implications for your business — is essential.

Why M&A Activity Is Accelerating

Several factors are fueling consolidation and investment in industrial automation:

- Digital Transformation Pressure: Manufacturers are racing to integrate advanced technologies like AI, IoT, and predictive analytics. Acquiring specialized firms accelerates this journey.

- Global Competition and Scale: Larger players seek economies of scale and expanded geographic reach to remain competitive in a globalized market.

- Talent and Expertise: Skilled labor shortages make acquisitions an attractive way to secure engineering talent and niche expertise.

Key Trends Shaping the Landscape

- Strategic Partnerships Over Pure Consolidation: Companies aren’t just buying for size — they’re acquiring capabilities. Expect more deals focused on software integration, cybersecurity, and data analytics.

- Private Equity’s Growing Role: Investment firms see automation as a long-term growth sector, driving valuations higher and increasing deal complexity.

- Focus on Sustainability and ESG: Environmental, social, and governance considerations are influencing acquisition strategies, particularly in energy-intensive industries.

- Technology-Driven Valuations: Businesses with strong digital platforms or AI capabilities command premium valuations, even if traditional metrics lag.

Challenges to Navigate

While opportunities abound, M&A in industrial automation comes with hurdles:

- Integration Complexity: Aligning systems, processes, and cultures can derail synergies if not managed carefully.

- Cybersecurity Risks: Acquiring companies with weak security protocols can introduce vulnerabilities.

- Regulatory Scrutiny: Cross-border deals face increasing compliance requirements, adding time and cost.

Looking Ahead

The next wave of M&A will likely center on enabling smarter, more connected operations. Companies that approach deals with a clear strategic vision — rather than chasing scale alone — will be best positioned to thrive.

For industry leaders, the takeaway is clear: adaptability and foresight are critical. Whether you’re considering an acquisition or preparing for market shifts, understanding these trends can help you make informed decisions in a rapidly changing environment.

Bryan Powrozek, CPA, CGMA, is a partner with Wipfli Advisory LLC. WIPFLI partners with CSIA to provide members with business and tech advisory services from a firm that understands your unique business needs.

A version of this article was originally published on the WIPFLI website.

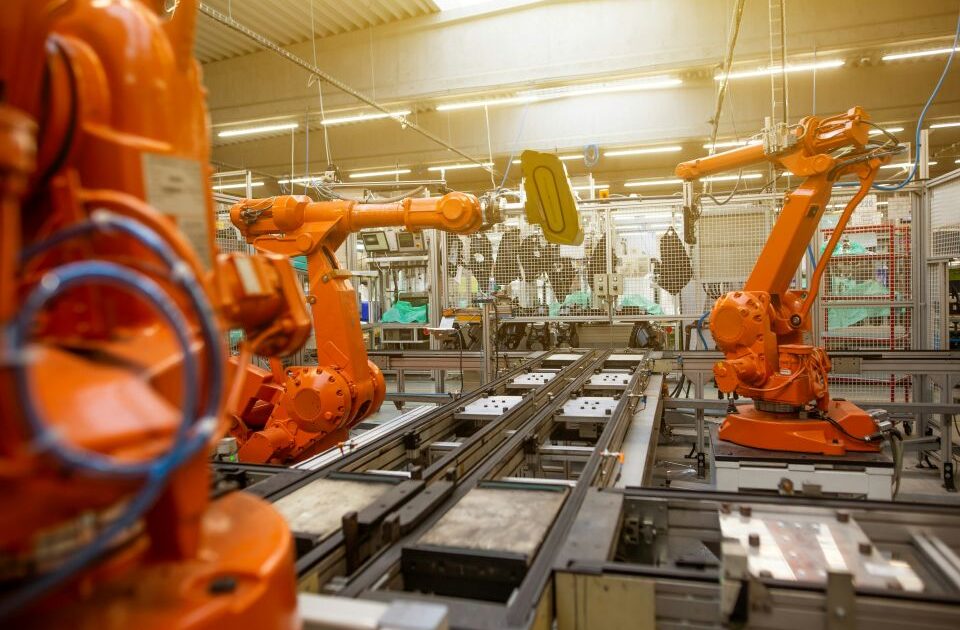

Photo credit: Photo by Simon Kadula on Unsplash